Global・Venture・Achievement

GVA Professional Group

Fostering positive societal impact by empowering

clients to succeed in their

goals and endeavors

through effective legal solutions.

Support

We provide our services that are tailored to various phases of a company’s business

Speciality Teams

Our speciality teams provide the best legal services

-

Fintech

新たな金融サービスの創設・設計等に関するアドバイスや、金融関連の許認可・業登録の取得等をサポート

-

Medical / Healthcare /Cosmetic Industry

医療ヘルスケア領域のビジネスモデル設計、薬事広告対応、医療情報関連のサポート等を幅広く提供

-

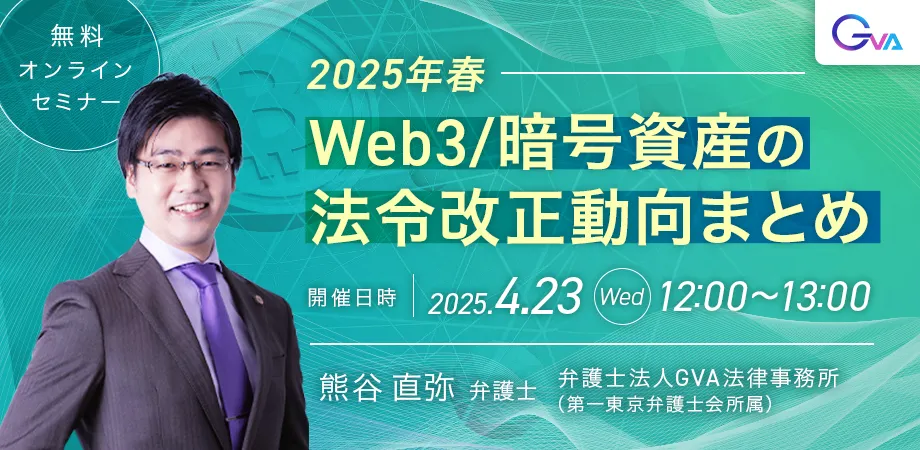

Web3

暗号資産・NFT・DeFi・STOなどWeb3ビジネスに対し、最新の法務サポートを提供

-

Metaverse / Entertainment

メタバースをはじめ、動画配信やesportsなど豊富な知識を有する弁護士が多角的な法的サポートを提供

-

Aerospace

ロケット・人工衛星・ドローンの製造・運用やデータ利用事業等の許認可・国内外の契約等を支援

-

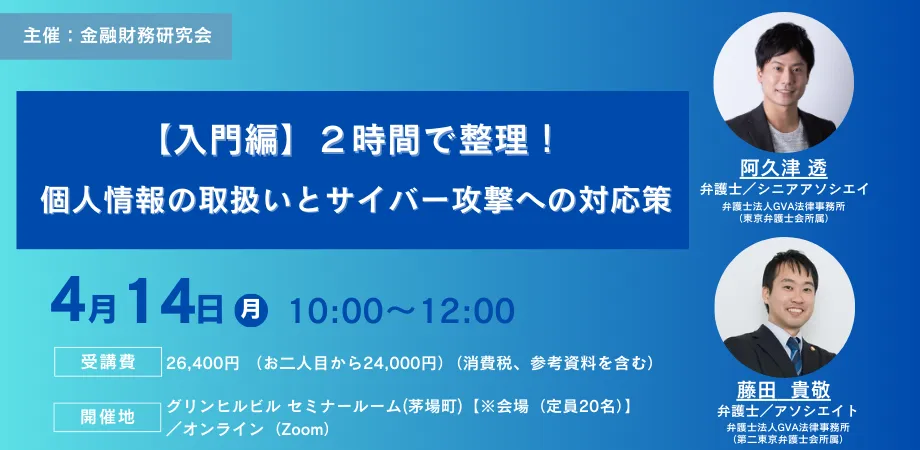

AI/Data (Protection of Personal Information etc.)

データ利活用、マーケティング施策や情報漏えい対応等、AI・データ分野に関するサポートを提供

-

M&A

スタートアップ支援に加え、M&Aの場面における売り手様・買い手様のサポートに注力

-

Third-Party Committee

独立性と透明性を兼ね備えた第三者委員会の設置・運営を全面的に実施します

-

Global

GVA Professional Groupの各拠点メンバーが連携し、日本企業の国際取引や海外進出に伴う法務課題についてサポート

News

About Us

Overview

Offices

Contact

Services

Legal RetainerLegal Retainer

Based on our clients’ industries, business models, and business life cycle, GVA LPC creates a legal advisory plan that meets their needs. In addition, we provide legal service packages that are specialized in specific areas.

SupportSupport

In general, legal services vary with the size or cycle of our clients’ businesses. However, GVA LPC provides our clients with the best support to meet their needs regardless of the type or size of their businesses.

Practice AreasPractice Areas

GVA has been supporting a large variety and category of businesses. We provide our clients with solutions to solve a wide range of legal issues by utilizing our experience.

Speciality TeamsTeams

We have set up “Speciality Teams” consisting of experts in FinTech, Medical/Healthcare/Cosmetic Industry, Web3, Metaverse, and Aerospace for each industrial field to resolve emerging legal issues in each of those fields.

Members

Legal blog

-

Overview of Japan’s Personal Information Protection Law

Overview of Japan’s Personal Information Protection Lawby:Kensho Onoda、Poom Kerdsang Summary Introduction Japan’s Act on the Protection of Personal Information (“APPI”) is a comprehensive data protection framework designed to balance the protection of individual (data subject) rights while promoting the effective use of data. APPI imposes obligations such as specifying and notifying the purpose of use, prohibiting use beyond the specified purposes, implementing security safeguards, restricting the provision of personal information to third parties, and responding to requests from individuals. While APPI shares similarities with other major data protection regimes, including the GDPR, it also incorporates several unique concepts, such as “Personal Related Information”, that require…

-

JAPAN Corporate Governance Structure

JAPAN Corporate Governance Structureby:Kensho Onoda、Poom Kerdsang Introduction One of the most important initial decisions when establishing a corporation in Japan is to decide on an appropriate corporate governance structure. The corporate governance structure determines how decision-making, business execution, and oversight are structured within the company. Under Japan’s Companies Act, companies have a certain level of flexibility in selecting and combining governance bodies, provided that the statutory requirements are met. An effective governance structure should reflect the company’s size, capital composition, and shareholder relationships. This article provides a detailed explanation of the fundamental concepts of corporate governance structure, available legal framework, and practical…

-

Marketing Regulations Part 1: Navigating Japan’s Advertising Regulations: Restrictions on Advertising Claims

Marketing Regulations Part 1: Navigating Japan’s Advertising Regulations: Restrictions on Advertising Claimsby:Kensho Onoda、Poom Kerdsang 0. Introduction Advertising and marketing activities in the Japan are subject to strict consumer protection rules. At the center of these rules is the Act against Unjustifiable Premiums and Misleading Representations (the “Premiums and Representations Act”). This article focuses particularly on the Act’s regulation of representations (“advertising claim”), outlining the its objectives, regulatory requirements, violation consequences and risks, as well as key considerations for foreign companies seeking to enter the Japanese Market. 1. Overview The Premiums and Representations Act was enacted in 1962 and is administered by the Consumer Affairs Agency as part of Japan’s consumer…

-

Choosing the Right Corporate Form in Japan: Kabushiki Kaisha (K.K.) vs. Godo Kaisha (G.K.)

Choosing the Right Corporate Form in Japan: Kabushiki Kaisha (K.K.) vs. Godo Kaisha (G.K.)by:Kensho Onoda、Poom Kerdsang Introduction Foreign companies and entrepreneurs expanding into Japan often face a unique choice between two types of limited liability companies: Kabushiki Kaisha (K.K.) and Godo Kaisha (G.K.). While both forms protects owners with limited liability, they differ significantly in key respects such as incorporation costs, operational flexibility, social credibility, and fundraising capacity. Understanding these differences is crucial for selecting the structure that best aligns with your business objectives in Japan. This article explains the features of each and offers practical guidance to help businesses make the right choice. 1. Historical Background and Basic Structure Kabushiki Kaisha…

-

Comparison of Japan Business Entry Methods

Comparison of Japan Business Entry Methodsby:Kensho Onoda、Poom Kerdsang Introduction The Japanese market, with its scale, consumer purchasing power, and high technological capabilities, is an attractive investment destination for many companies, including overseas startups. However, Japan’s legal system and business practices can differ significantly from those abroad. Choosing the right base structure for market entry is a crucial strategic decision that can significantly impact future business development. This column explains the characteristics, advantages, and disadvantages of four main forms that foreign companies should consider when entering Japan: establishing a subsidiary, setting up a branch office, opening a representative office, and acquiring a local corporation….

-

Legal considerations for foreigners conducting recruitment in Japan

Legal considerations for foreigners conducting recruitment in Japanby:Kensho Onoda、Poom Kerdsang 1. Methods of Recruitment When hiring personnel in Japan, foreign companies can utilize services broadly categorized into “public agency support” and “private services.” 1-1. Support from public agencies The most representative example is the Public Employment Service (called “Hello Work”), administered by the Ministry of Health, Labour and Welfare. Hello Work offices are located nationwide and provide free job matching services for all occupations. By submitting job postings, companies can reach a wide range of job seekers, and Hello Work also serves as a window for procedures related to labor insurance. At Hello Work, communication is generally…